Association of International Certified Professional Accountants

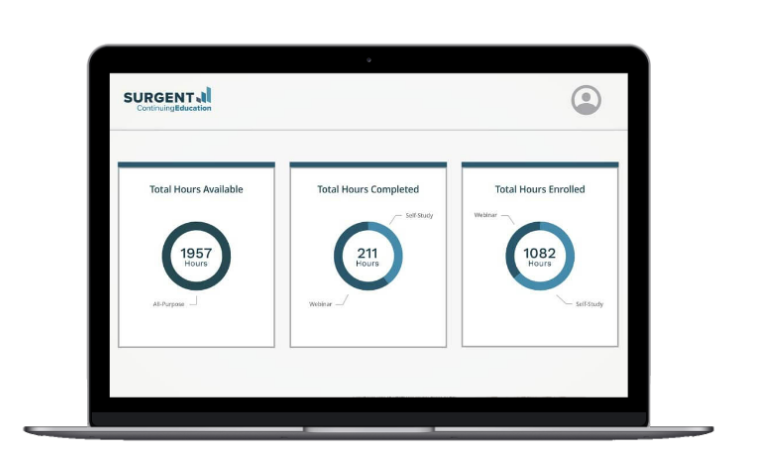

Get on the fast track with Surgent Exam Review today

Accounting Professional Trainers with corporate experience

400+ hours of pre-recorded class and self-learning platform

12 – 18 months of

completion period

Expert instructors who make complex concepts simpler

Adaptive learning to focus you where you need help

1:1 virtual coaching with Ultimate and Premier Passes

Short videos and mobile flash cards

Continually updated course material

CPA certification is a globally recognized designation and is the highest standard of competence in Accountancy. The CPA course examination is administered by the American Institute of Certified Public Accountants (AICPA), which is the world's largest accounting body.

Register for a FREE Demo Class Today

Area I: Conceptual Framework, Standard-Setting, and Financial Reporting – 25-35%

Area II: Select Financial Statement Accounts 30-40%

Area III: Select Transactions 20-30%

Area IV: State and Local Governments 5-15%

Area I: Ethics, Professional Responsibilities and Federal Tax Procedures 10-20%

Area II: Business Law 10-20%

Area III: Federal Taxation of Property Transactions 12-22%

Area IV: Federal Taxation of Individuals 15-25%

Area V: Federal Taxation of Entities 28-38%

Section Time : 4 hours

Multiple Choice Questions : 72

Task Based Simulations: 8

Written Communication: -

Section Time : 4 hours

Multiple Choice Questions : 62

Task Based Simulations: 4

Written Communication: 3

Section Time : 4 hours

Multiple Choice Questions : 66

Task Based Simulations: 8

Written Communication: -

Section Time : 4 hours

Multiple Choice Questions : 76

Task Based Simulations: 8

Written Communication: -

You must meet each prerequisite listed below in order to be qualified for CPA certification:

To be eligible to appear for the US CPA exam one must have 120 credits, each graduation is converted into 30 years of credits thereby adding 90 credits for 3 years, if your NAAC A, the first division you will get 30 additional credits. To apply for the license, one must have 150 credits

Candidate should pass the Ethics exam. 150 Credit Hours : candidates must complete the university education with 150 credit hours. 2000 hours of work experience: candidates are required to have 2,000 hours of work experience in taxation, financial accounting and reporting, auditing, accounting, and the management consultancy.

The Exam is a 16-hour, four-section test that all jurisdictions require you to pass in order to qualify for a CPA license. It is designed to test the minimum knowledge and skills required of a CPA. The CPA Exam is owned by the AICPA, and administered in Prometric test centres by NASBA and the AICPA on behalf of the state boards of accountancy.

You must pass all four sections of the CPA Exam within 18 months. The calculation of when the 18-month timeframe begins varies by jurisdiction.

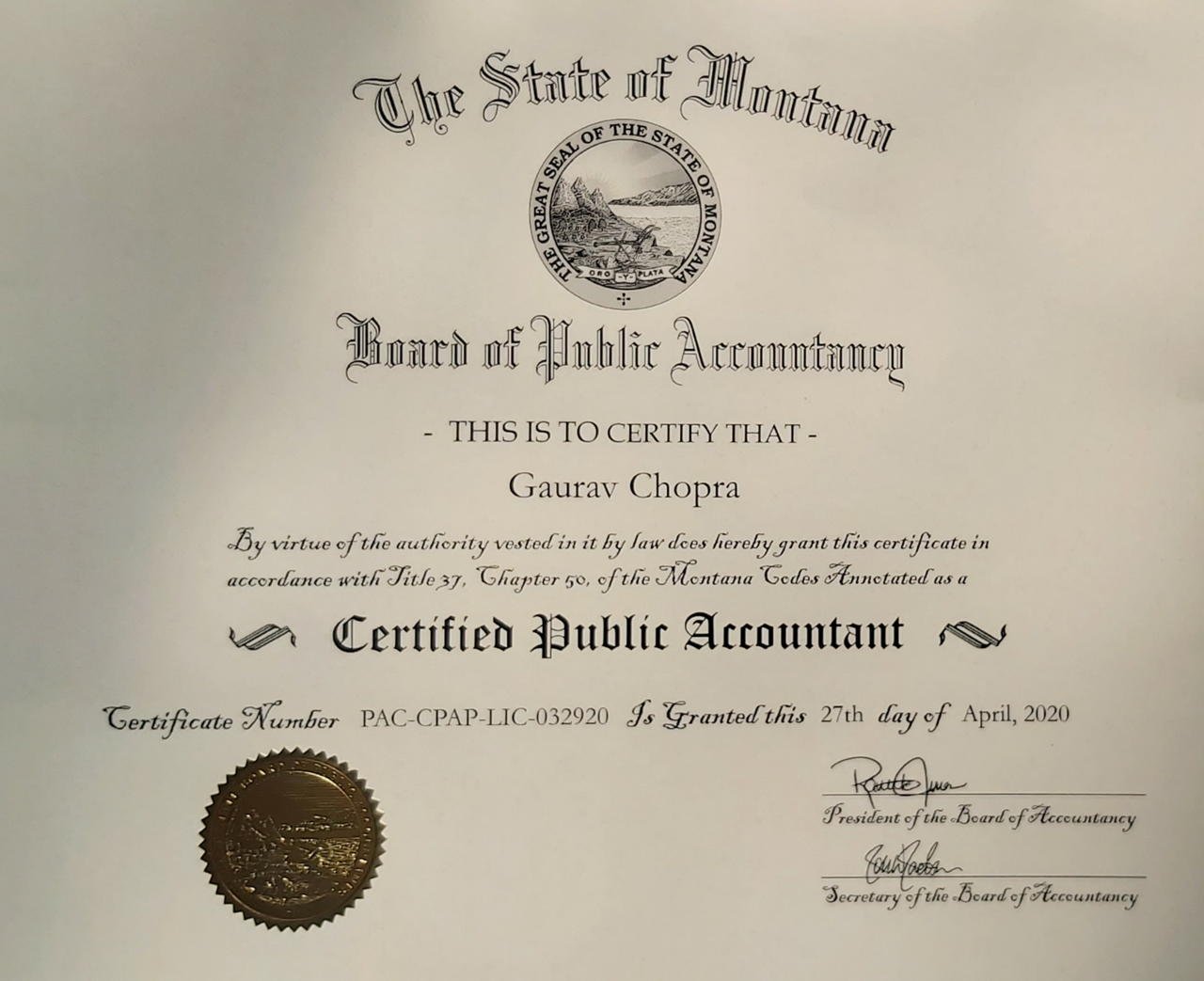

CPA Stands for Certified Public Accountant and the CPA

certification is issued by the State Board of Accountancy.

Individual state boards set their CPA exam requirements. Most

states will have a similar core set of CPA requirements with

minor differences to be eligible for CPA exams. The educational

and experience requirements of the CPA exam and License are as

follows. In order to be eligible for the CPA exam, Candidates

must be an undergraduate doing their post-graduation with a

minimum of 120 semester hours. For CPA License- Candidate must

have completed their Post Graduation Degree with a minimum of

150 semester hours.

Anyone who meets the set CPA eligibility requirements can take

the CPA exam. State Jurisdiction will set the eligibility

criteria for CPA candidates, if you meet the set standards, you

can take the exam. Some of the standard prerequisites for the

CPA exam in any state are:

Candidates must be a

graduate or have an equivalent degree.

A minimum of 1-2

years of continuous work experience under any CPA.

150

semester hours of Post-Graduation or college course for a CMA

License.

Every state has a separate set of requirements for CPA License

issues. A CPA license is issued by the State Board of

Accountants. Here is the standard prerequisite for issuing a CPA

License.

Candidates must be a graduate or have an

equivalent degree.

A minimum of 1-2 years of continuous

work experience under any CPA.

150 semester hours of

Post-Graduation or college course for a CMA License.

Pass

the ethics exam.

CPA stands for Certified Public Accountant and the CPA

certification is issued by the State Board of Accountancy. The

CPA exam is mainly divided into four papers or modules as

follows:

Paper-1: Financial Accounting & Reporting

(FAR)Conceptual Framework, Standard Setting, and Financial

ReportingSelect Financial Statement AccountsSelect

TransactionsState and Local Governments

Paper-2:

Auditing & Attestation (AUD)Ethics, Professional

Responsibilities, and General PrinciplesAssessing Risk and

Developing a Planned ResponsePerforming Further Procedures and

Obtaining EvidenceForming Conclusions & Reporting

Paper-3:

Regulation (REG)

Business Law

Individual Federal

Taxation

Property Transaction Federal Taxation

Entity

Federal Taxation

Professional Responsibilities, Ethics, and

Federal Tax Procedures

Paper-4: Business Environment

& Concepts (BEC)Economic Concepts and Analysis

Operations Management

Corporate Governance

Financial

Management

Information Technology

Completing your CPA course can open doors to a plethora of job

and career opportunities. CPA is highly valued by most global

organizations and here are some of the job titles that companies

hire CPA professionals for

Financial Advisor

Risk

and Compliance Professional

Internal Auditor

Corporate

Controller

Tax Compliance

Personal Financial

Advisor

Finance Director

Financial Accounting and

Reporting

Candidates can select the job title they

want to work in based on their short-term, long term goals,

desired salary, ability, skills, and experience.