Admissions to

Placement Ratio

Pass

Percentage

Placements in

Last 1415 days

South India's No.1 in

Results & Placements

Highest

CTC

Hiring

Partners

Why choose Invisor's CPA USA?

Duration

12 – 18 months of completion period

Personalized

1:1 virtual coaching with Ultimate and Premier Passes

Focused

Adaptive learning to focus you where you need help

Expert Guidance

Accounting Professional Trainers with corporate experience

Simplified

Expert instructors who make complex concepts simpler

Accelerate

Get on the fast track with Surgent Exam Review today

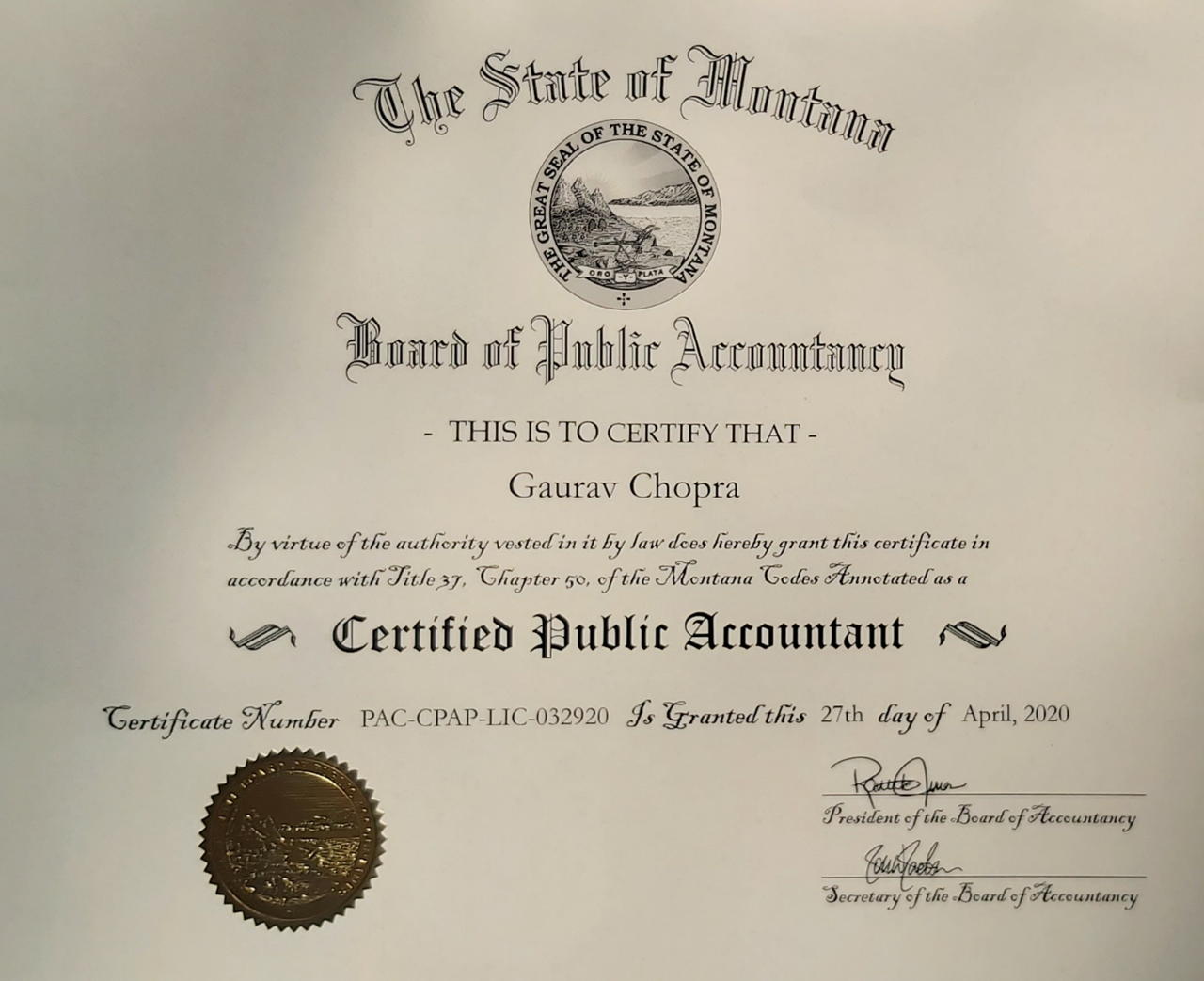

You must meet each prerequisite listed below in order to be qualified for CPA certification:

- Candidate should pass the Ethics Exam.

- 150 Credit Hours : candidates must complete the university education with 150 credit hours.

- 2000 hours of work experience: candidates are required to have 2,000 hours of work experience in taxation, financial accounting and reporting, auditing, accounting, and the management consultancy.

Exam Structure CMA USA

The CMA examination is administered at Prometric Testing Centres across the world in a computer-based style.

Paper 1

Auditing and Attestation (AUD)

4 hours – 100 multiple-choice questions & two 30-minute essays

Section Time : 4 hours

Multiple Choice Questions : 72

Task Based Simulations: 8

Written Communication: -

Paper 2

Business Environments & Concepts (BEC)

Section Time : 4 hours

Multiple Choice Questions : 62

Task Based Simulations: 4

Written Communication: 3

Paper 3

Finance Accounting and Reporting (FAR)

Section Time : 4 hours

Multiple Choice Questions : 66

Task Based Simulations: 8

Written Communication: -

Paper 4

Regulation (REG)

Section Time : 4 hours

Multiple Choice Questions : 76

Task Based Simulations: 8

Written Communication: -

What you'll learn

Area I: Ethics, Professional Responsibilities, and General Principles (15-25%)

- Nature and scope

- Ethics, independence, and professional conduct

- Terms of engagement

- Requirements for engagement documentation

- Communication with management and those charged with governance

- Communication with component auditors and parties other than management and those charged with governance

- A firm's system of quality control, including quality control at the engagement level

Area II: Assessing Risk and Developing a Planned Response (20-30%)

- Planning an engagement

- Understanding an entity's internal control

- Debtor-creditor relationships

- Assessing risk due to fraud, including a discussion among the engagement team about the risk of material misstatement due to fraud or error

- Identifying and assessing the risk of material misstatement, whether due to error or fraud and planning further procedures responsive to identified risk

- Materiality

- Planning for and using the work of others, including group audits, the internal audit function and the work of a specialist

- Specific areas of engagement risk

Area III: Performing Further Procedures and Obtaining Evidence (30-40%)

- Acquisition and disposition of assets

- Sampling techniques

- Performing specific procedures to obtain evidence

- Specific matters that require special consideration

- Misstatements and internal control deficiencies

- Written representation

- Subsequent events and subsequently discovered facts

Area IV: Forming Conclusions and Reporting (15-25%)

- Reports on auditing engagements

- Reports on attestation engagements

- Accounting and review service engagements

- Reporting on compliance

- Other reporting considerations

Area I: Corporate Governance (17-27%)

- Internal control frameworks

- Enterprise risk management (ERM) frameworks

- Other regulatory frameworks and provisions

Area II: Economic Concepts and Analysis (17-27%)

- Economic business cycles

- Market influences on business

- Financial risk management

Area III: Financial Management (11-21%)

- Capital structure

- Working capital

- Financial valuation methods and decision models

Area IV: Information Technology (15-25%)

- Information technology (IT) governance

- Role of information technology in business

- Information security/availability

- Processing integrity (input/processing/output controls)

- Systems development and maintenance

Area V: Operations Management (15-25%)

- Financial and non-financial measures of performance management

- Cost accounting

- Process management

- Planning techniques

Area I: Conceptual Framework, Standard-Setting, and Financial Reporting (25-35%)

- Conceptual framework and standard setting for nonbusiness entities

- General purpose financial statements: for-profit business entities

- General purpose financial statements: nongovernmental, not-for-profit business entities

- Public company reporting topics

- Financial statements of employee benefit plans

- Special purpose framework

Area II: Select Financial Statement Accounts (30-40%)

- Cash and cash equivalents

- Trade receivables

- Inventory

- Property, plant, and equipment

- Investments

- Intangible assets

- Payables and accrued liabilities

- Long-term debt

- Revenue recognition

- Compensation benefits

- Income taxes

Area III: Select Transactions (20-30%)

- Accounting changes and error corrections

- Business combinations

- Contingencies and commitments

- Derivatives and hedge accounting

- Foreign currency transaction and translation

- Leases

- Nonreciprocal transfers

- Research and development costs

- Software costs

- Subsequent events

- Fair value measurements

- Differences between IFRS and U.S. GAAP

Area IV: State and Local Governments (5-15%)

- State and local government concepts

- Format and content of the financial section of the comprehensive annual financial report (CAFR)

- Deriving government-wide financial statements and reconciliation requirements

- Typical items and specific types of transactions and events: measurement, valuation, calculation, and presentation in governmental entity financial statements

Area I: Ethics, Professional Responsibilities, and Federal Tax Procedures (10-20%)

- Ethics and responsibilities in tax practice

- Licensing and disciplinary systems

- Federal tax procedures

- Legal duties and responsibilities

Area II: Business Law (10-20%)

- Agency

- Contracts

- Debtor-creditor relationships

- Government regulation of business

- Business structure

Area III: Federal Taxation of Property Transactions (12-22%)

- Acquisition and disposition of assets

- Cost recovery (depreciation, depletion, amortization)

- Estate and gift taxation

- Transfers subject to gift tax

- Gift tax annual exclusion and gift tax deductions

- Determination of taxable estate

Area IV: Federal Taxation of Individuals (15-25%)

- Gross income (inclusions and exclusions)

- Reporting items from pass-through entities

- Adjustment and deductions to arrive at adjusted gross income and taxable income

- Passive activity losses

- Loss limitations

- Filing status

- Computation of tax and credits

- Alternative Minimum Tax

Area V: Federal Taxation of Entities (28-38%)

- Tax treatment of formation and liquidation of business entities

- Differences between book and tax income

- C corporations

- S corporations

- Partnerships

- Limited liability companies

- Trusts and estates

- Tax-exempt organizations

Know about the course

Meet Our Instructors

- Founder & CEO Invisor

- Qualified MBA, CMA, CSCA, CPB, EA

- 10+ years of corporate experience

- Business Transformation Specialist

- Author of IMA Approved textbook

- Co-Founder & COO Invisor

- Certified management accountant

- 7+ years of experience

- Founder of Job Portal : Fintalent

- Member of board of studies at UGC

- 5+ years of experience

- Former Senior Analyst at Goldman Sachs

- 5+ years of experience

- Former Analyst at RSM Dubai

600 +

placements

Get placed in top companies

Unlock opportunities. Our impeccable placement record opens doors to leading companies, propelling careers.

1415

DAYS

600

1415

Riya Shibu

Vishnupriya

Don Alias

Ameena M R

Abhishikth S

Kevin T

Noel kurian

Ajin Kavalackal

Dhanalaskhmi K T

Nevin Abraham

Akshay MD

Kiran Johny

Jishnu

Rebin Jacob

Linta Johnson

Nevin Abraham

Vishnu KB

Anurag C

Safar Aflah

Dona Mathew

Neeraja

Alen Kuriakose

Results

We work with industry leaders to design and deliver innovative and career-centric programs.

Amanda Rose Tomy

EA USA

Aibin Johnson Benny

EA USA

Akshai Stephen

EA USA

Nandhu T

EA USA

500

Aleena Babu

CMA USA

500

Muhammed Ameen KS

CMA USA

500

Krishnapriya T J

CMA USA

500

Asna Mol

CMA USA

Hiring Partners

Over 600 students placed in 50+ top companies.

Hear from Our Students

Hi I am Vinu. After completion of my CMA, I applied to a lot of openings through many job banks . But I did not get any response from the recruiters. Then I got heard about First Career Program run by one of my faculty Mr Alex. I took a chance by enrolling for the program. I swear it was the best decision I have ever made. The projects assigned by Geevar Thambi, CMA, CSCA and Alex Tom Joseph, CMA has really helped me to get an idea about how the industry works and gain practical experience

In a platform where many search for jobs, I believe my experience is worth sharing. I graduated with my BCom in 2021 and completed CMA US in 2022. From then, I rigorously applied for jobs but faced constant rejections due to a lack of experience. That's when I found the First Career Program at Invisor. Enrolling gave me hands-on experience, industry exposure, and the skills I needed. Thanks to the program, I finally secured my first job—one of the best decisions I've made!

I'm here to share my journey after completing CMA USA. As a fresher, I struggled to get a job at MNCs and faced constant rejections, which was frustrating. Then I heard about the First Career Program from my CMA tutor, Alex Tom Joseph, CMA. I was unsure about joining, but taking the chance was the best decision. The hands-on experience and expert guidance helped me gain the skills I lacked. Thanks to the program, I finally secured a job at an MNC!

My journey with Invisor was so good, i was doing FCP for past two months and i'm placed recently. The faculty were supportive to doing works and also they provide voice and accent training to improve our communication skills. It will definitely help us in interviews .

.webp)